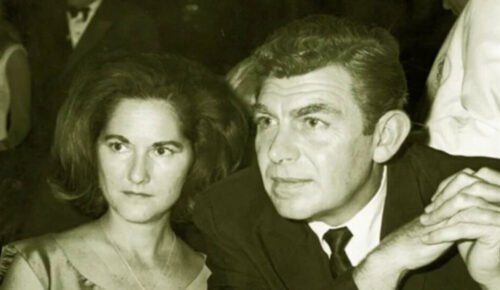

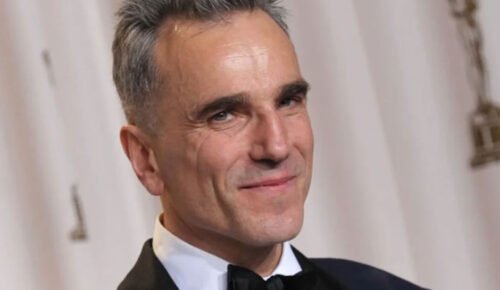

The finance guru, Andre Hakkak, is well-known for his investments and business ventures. Hakkak is the cofounder and Chief Investment Officer at White Oak Global Advisors, an investment firm whose net worth is estimated at USD 200 million – USD ten billion. He’s a financial expert and an investor with innovative strategies.

Early Life and Education

Born January 5, 1973, in Tehran, Iran, Andre Hakkak moved to the United States from Iran with his family for better opportunities. A supportive family environment encouraged his early interest in finance. Hakkak later graduated from the University of California at Berkeley with a Bachelor of Science in Finance and Marketing out of the HaaS School of Business. He then received a master of finance degree at the University of Chicago.

Career and Achievements

Hakkak started out as an investment banker with Robertson Stephens & Co. His strategic vision and inventive thinking helped him found White Oak Global Advisors, which today manages assets of over USD 10 billion. The firm is a success because of Hakkak’s leadership and expertise.

Many awards have been given to Andre Hakkak for his work in finance and philanthropy. His work has helped him personally and has also helped the finance world in general.

Exploring Andre Hakkak’s Net Worth and Factors Contributing to His Wealth

Hakkak has an estimated net worth of between USD 200 million and USD 10 billion. This wealth was accumulated as a result of is financial acumen. But what exactly has made him so rich? Let’s find out.

White Oak Global Advisors: The Cornerstone

Hakkak founded and is the Chief Investment Officer of White Oak Global Advisors. This firm with over USD 10 billion in assets helps small and medium-sized businesses. They have helped hundreds of companies and this has helped Hakkak significantly improve his financial status.

Diversification: Spreading the Risk

Hakkak bases his investment strategy on diversification. He has spread his wealth across several sectors like real estate, fixed income and alternative investments. All this combined with keen market analysis and risk management has paid off.

Real Estate: A Tangible Asset

Owning a luxurious Miami mansion is one example of Hakkak’s smart real estate investments. These properties have been solid, long-term assets adding to his wealth.

Philanthropy: Giving Back and Building a Brand

Giving back to the community has earned Hakkak respect and improved his public image. A reputation for being a philanthropist may help someone improve their image and, in turn, their finances.

Conclusion

From his humble beginnings in Tehran to a global financial giant – Andre Hakkak’s story is one of pursuit of excellence. He knows how to spot opportunities, hedge risks, and build successful businesses – making him a leading financial figure. His journey inspires entrepreneurs and investors worldwide.